UK Autumn Budget 2024 breakdown

The UK Autumn Budget 2024 has introduced measures that bring both challenges and opportunities for small optician businesses, including locums operating as independent entities. Mo Chaudhry of Locumkit breaks down the key takeaways that may affect you as a locum, employee and/or business owner in the optical sector…

Income tax bands and allowances (employees/locums)

Income tax thresholds remain unchanged, with the personal allowance staying at £12,570. While this is good news that there is no increase in tax rates, the freezing of the thresholds is a form of ‘stealth tax’.

UK tax rates through to 2028

Many employees will find that as they receive pay raises, they will gradually be pulled into higher tax bands until thresholds begin to rise again in 2028, hence paying more tax altogether.

National minimum wage (business owners/employees)

The Autumn 2024 Budget brings several changes that could substantially affect optician business owners, mainly through higher labour and operational costs. A major factor is the rise in the national living wage.

Change in minimum wage rates, effective from April 2025

These changes will drive up payroll expenses, directly impacting profitability. For instance, costs for a full-time employee on minimum wage could rise by around £2,160 annually.

This increase comes at a challenging time, with businesses already feeling pressure on margins in a highly competitive market. Business owners will need to factor these additional wage costs into their budgets, potentially affecting recruitment plans and pricing strategies.

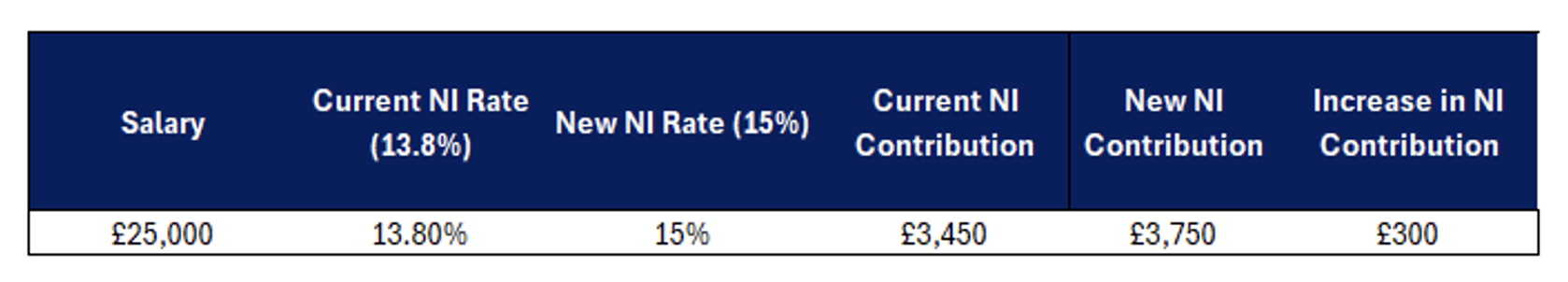

Employer National Insurance contributions (business owners)

Employers face additional pressure with National Insurance increases set to take effect from April 2025. Below, we outline these hikes and, more importantly, the impact they may have on business owners.

Impact of National Insurance rate increase

Below we illustrate the impact this has on the business on someone who is being paid £25,000.

Impact of National Insurance rate increase

There is some relief for small independent employers with staff, while an increase in employer NICs will be noticeable, the impact should be offset by the rise in the employment allowance – from £5,000 to £10,500. This increase is expected to minimise, if not eliminate, any effect on your bottom line.

For locums who are the sole directors of their own limited companies, the change to the employer’s NI threshold will affect how you draw your salary, as you are not eligible for the employment allowance. A revised strategy will be necessary to ensure your tax efficiency, so it’s advisable to consult with your accountant to determine the best approach for receiving income from your business when the change takes effect in April 2025.

Dividends (business owners/locums)

Unfortunately, for those locums who operate under a limited company structure, there was no mention of changes to the dividend allowance. Thsi will remain at £500 per year (this is a significant drop from the £5,000 allowance available just five years ago).

Making Tax Digital (locums)

The scope of Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) has been expanded to include more self-employed individuals.

What we already knew:

• From April 2026, MTD for ITSA will apply to self-employed individuals and landlords earning more than £50,000

• From April 2027, it will apply to those with incomes between £30,000 and £50,000

Following the recent budget, it’s now confirmed that locums earning more than £20,000 will also be required to register; though the exact timeline is yet to be announced.

Corporation tax (business owners/locums)

There are no new increases here (the previous government had already implemented them), but the rates will remain fixed for the duration of this parliament. This stability offers greater predictability, making it easier to plan/budget and invest with a clearer view of your tax liabilities over the long term.

Annual investment allowance (business owners)

The annual investment allowance (AIA) remains at £1m, enabling optical practices to claim deductions on substantial capital investments. To achieve the best financial outcomes, we advise you to consult with an accountant regarding planned investments to manage VAT implications and ensure minimum expenditure thresholds are met effectively.

Business rates (business owners)

A further blow to optical practitioners is the reduction in the business rates discount – from 75 per cent to 40 per cent in April 2025. This could result in many owners seeing their High Street business rates double.

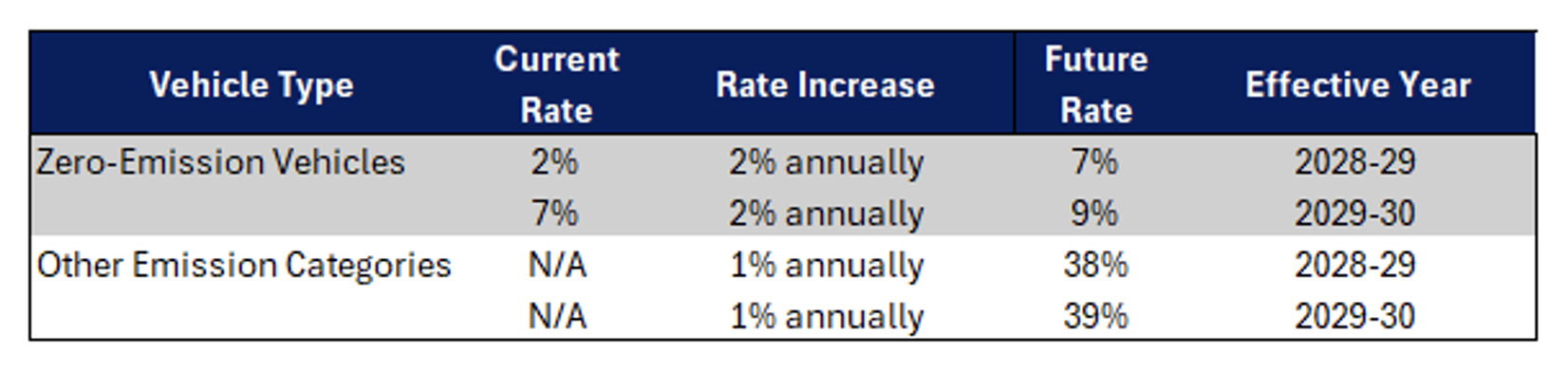

Benefit-in-kind for electric vehicles (business owners/locums)

The company car tax rate for zero-emission vehicles will increase gradually in the coming years as follows.

Change in benefit-in-kind rates on company cars

Businesses purchasing electric cars should take into account the potential long-term cost implications of these tax increases. Business owners may want to consider offering electric cars to employees through salary sacrifice schemes, which could result in significant savings for both the employee and the business.

The budget also has confirmed that from April 2026, pay-rolling of benefits in kind will become mandatory. Benefits, such as company cars, private health insurance or gym memberships, are perks employees and directors receive that aren’t part of their salary. As a result, business owners will be required to process these benefits (and the associated taxes) through the payroll system regularly, replacing the current P11D form. Employers will also need to pay the Class 1A liability monthly, instead of as an annual lump sum.

For businesses not yet implementing this, the change in process may take some time to adjust to. If you provide benefits that are subject to tax, it’s recommended that you consult with your accountant to ensure you’re ready for this transition.

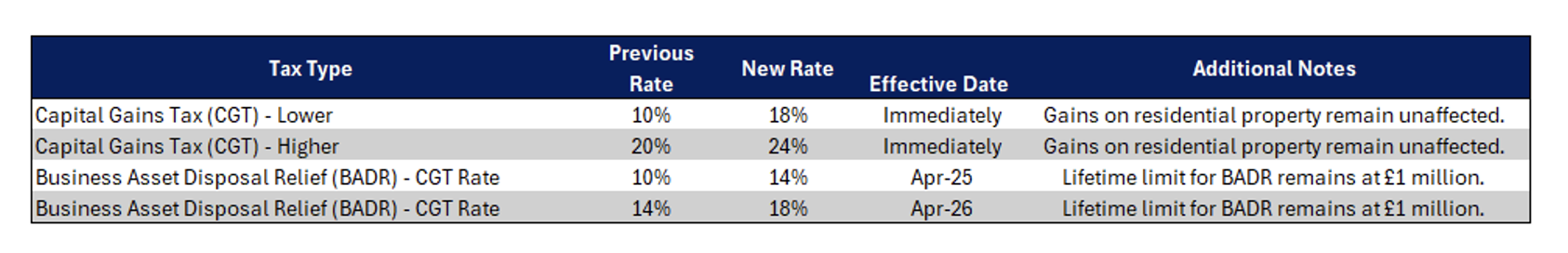

Capital gains tax (all)

Capital gains tax (CGT) applies to the profit made from selling assets that have appreciated in value, such as second homes or investments.

Change in capital gains tax rate

Capital gains taxes have risen across the board, but a key area to note is business asset disposal relief (BADR), previously known as entrepreneur’s relief.

If you’re considering selling or closing your business in the next few years, BADR is especially relevant. While the lifetime limit remains at £1m, an increase in the tax rate has been announced. Starting in April 2025, the rate will rise to 14 per cent, and from 2026/27, it will increase further to 18 per cent. Selling before April 2025 could mean significant savings, as much as eight per cent (e.g. £8,000 on a £100,000 gain).

Inheritance tax (all)

Inheritance tax (IHT) remains at 40 per cent and typically applies to the value of a deceased person’s estate exceeding £325,000 (or £500,000 if it includes a primary residence). This threshold will stay frozen until 2030.

A significant change is coming to pension inheritance: starting in April 2027, inherited pensions will be included in estate calculations for IHT, potentially reducing the tax efficiency of pensions for legacy planning.

Individuals may want to reassess their retirement strategies, particularly if pensions are their primary savings vehicle, and explore alternative tax-efficient options to reduce IHT exposure.

Pensions (all)

State pensions will increase by 4.1 per cent in April 25, in line with average earnings:

• For those on the new flat-rate state pension (for individuals reaching state pension age after April 2016), the full amount is expected to rise to £230.25 per week – an increase of £472 per year

• For those on the old basic state pension (for individuals reaching state pension age before April 2016), the full amount is anticipated to rise to £176.45 per week, which equates to an additional £363 per year

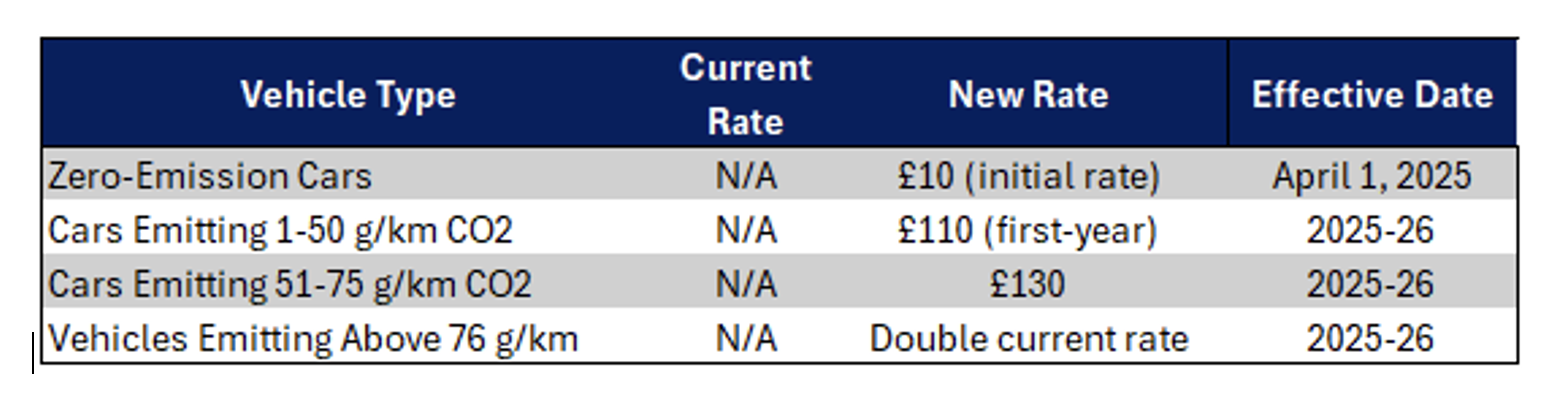

Vehicle excise duty (road tax) (all)

Starting 1 April 2025, road tax rates will change for new cars as follows:

Change in road tax rates

Stamp duty (land tax) (all)

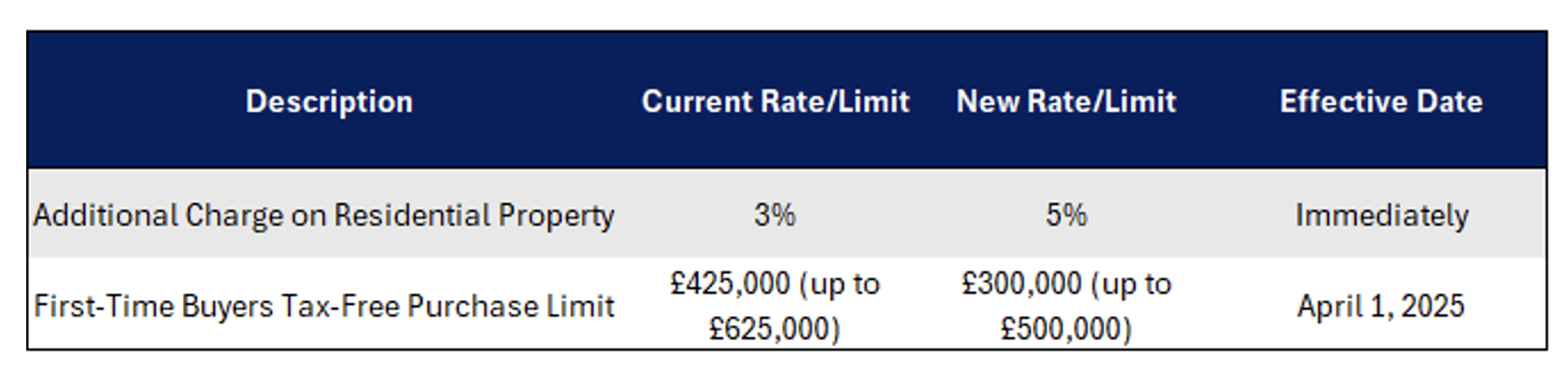

The announcement that stamp duty will rise on buy-to-let properties and second homes is likely to be unwelcome news for second homeowners and landlords.

Change in stamp duty land tax rates

Fuel duty (all)

There was significant anticipation that fuel duty would increase after a long period of being frozen. However, the chancellor has decided to extend the fuel duty freeze for another year, while maintaining the temporary additional 5p cut for the same period. This is positive news for those who rely on vehicles for work, as it means fuel prices at the pump will remain unaffected by tax increases for at least the next year.

Child benefit (all)

From 6 April 2024, the lower threshold for child benefit will be adjusted to £60,000, with a one per cent charge on every £200 of income above this level, maxing out at £80,000. Though the charge can eliminate the benefit, families are encouraged to still claim to secure potential future entitlements.

Interest on unpaid tax (all)

The interest rate on overdue taxes will rise by 1.5 percentage points, aligning it more closely with current market rates. The new rate is set at bank rate plus four percentage points.

HMRC compliance and enforcement (business owners/locums)

HMRC plans to add 5,000 officers to strengthen tax compliance efforts, particularly targeting sectors with higher rates of underpayment. Business owners should ensure their financial records are well-maintained, as this increase in staffing may result in more frequent audits and closer scrutiny.

Conclusion

Overall, the Autumn Budget signals increased costs for employers balanced by incentives for investment and some tax relief for smaller businesses. Careful financial planning will be essential for employers looking to meet these rising costs – while continuing to offer competitive wages and benefits.

Note: This summary is intended to provide general insights and should not replace specific professional guidance for individual situations.

If you’re looking for expert guidance through the financial twists and turns of the new budget you have further questions, Mo Chaudhry, a dual qualified optometrist and chartered accountant at Locumkit, can offer personalised advice. Email mochaudhry@locumkit.com for more details.